what is the salt deduction repeal

But you must itemize in order to deduct state and local taxes on your federal income tax return. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

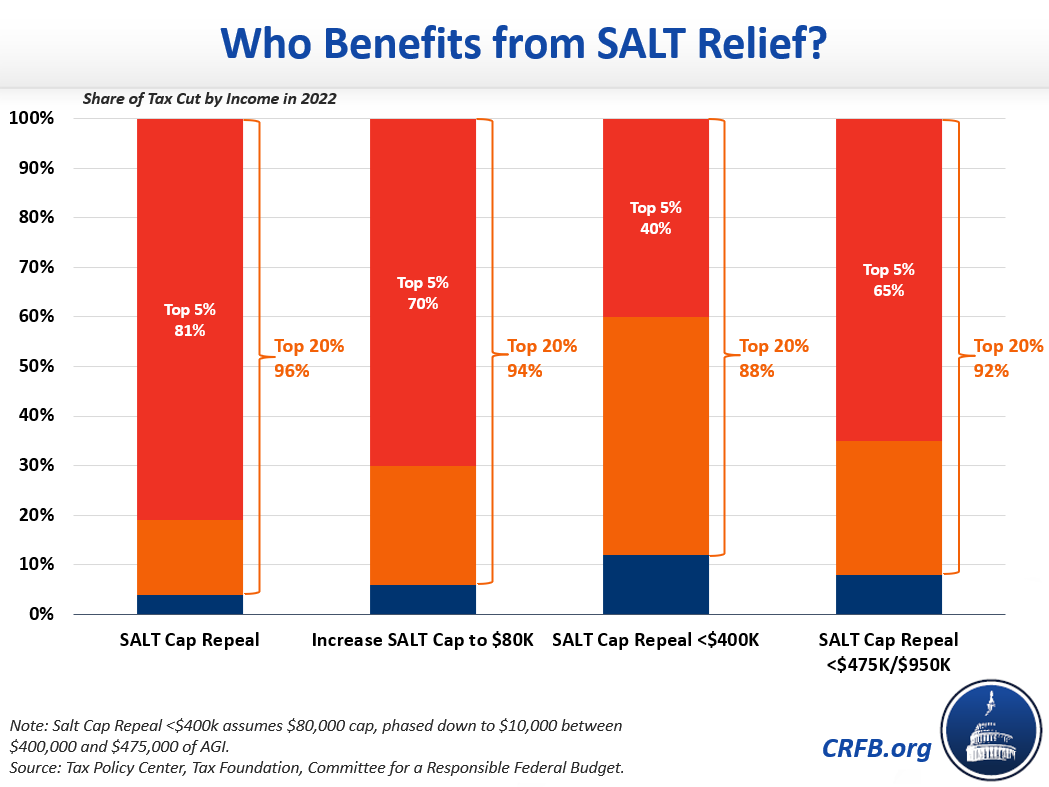

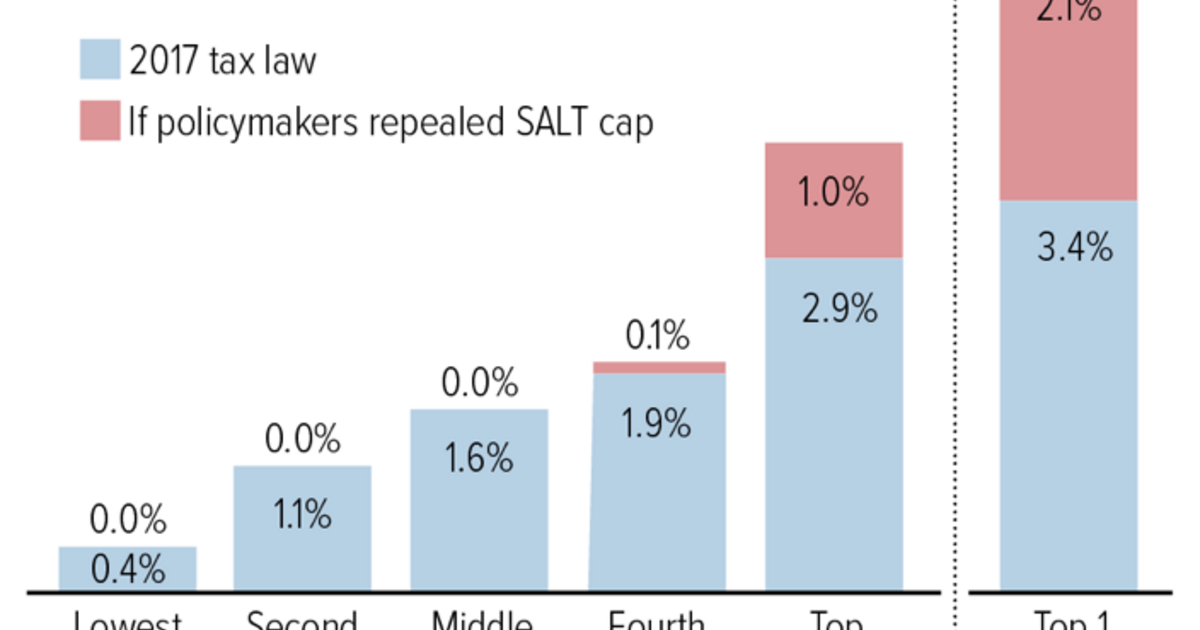

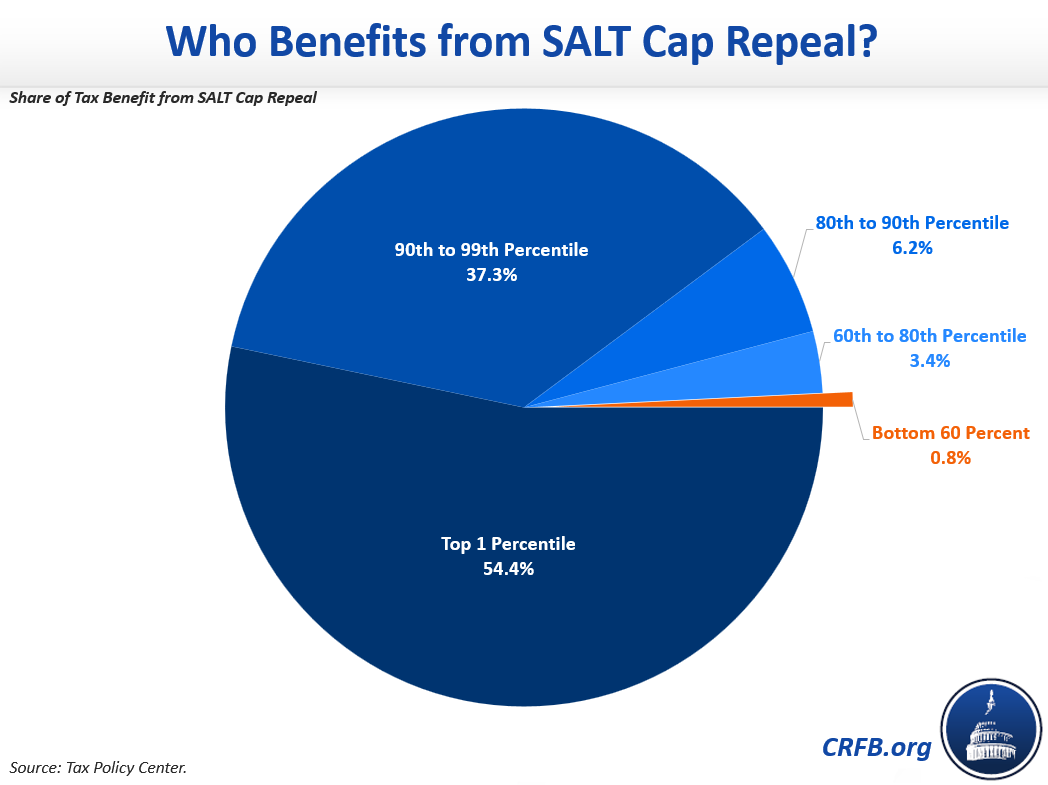

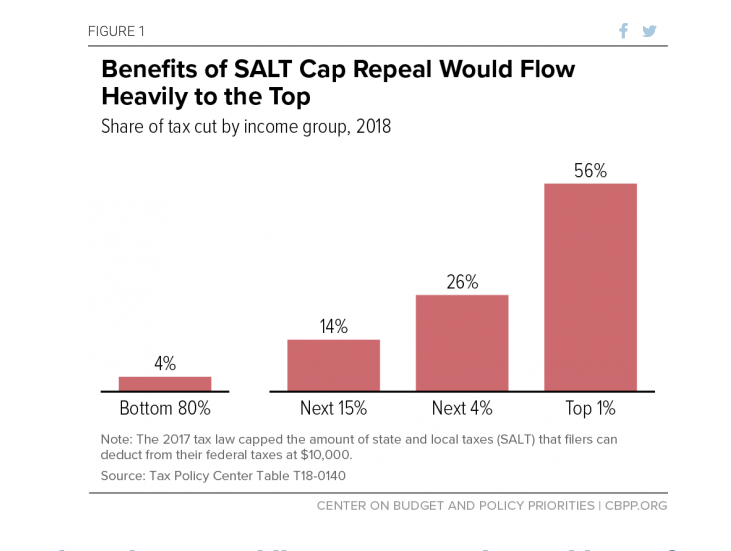

The SALT deduction when no cap is in place is a highly regressive tax policy meaning its benefits go to the wealthiest taxpayers who regularly write off over 10000 on.

. Policymakers are considering other options to reform or repeal the SALT deduction cap. For your 2021 taxes which youll file in 2022 you can only itemize when your. The SALT deduction benefits only a shrinking minority of taxpayers.

Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. But Sanders is open to a compromise that protects the middle class in high-tax states such as a SALT deduction cap repeal for those under a certain income threshold.

What is the salt deduction repeal. The SALT deduction is only available if you itemize your deductions using Schedule A. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

Tax Policy Center. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize. The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats.

Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT deduction to their Build Back Better. The push to repeal this cap a few.

Second the 2017 law capped the SALT deduction at 10000 5000 if. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. For example the 10000 SALT cap could be doubled for joint fillers who.

Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. The lawmakers have asked. A group of House Democrats pushing to lift the SALT cap most of them from New York and New Jersey insisted Wednesday the deduction is progressive and that the.

SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing.

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

State And Local Tax Salt Deduction Salt Deduction Taxedu

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Deduction Resources Committee For A Responsible Federal Budget

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Eliminating The Salt Cap To Help The Rich Doesn T Fight Coronavirus Ways And Means Republicans

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union